Network slicing not just pie-in-the-sky, but could give operator net profits a big boost

By Mae Kowalke

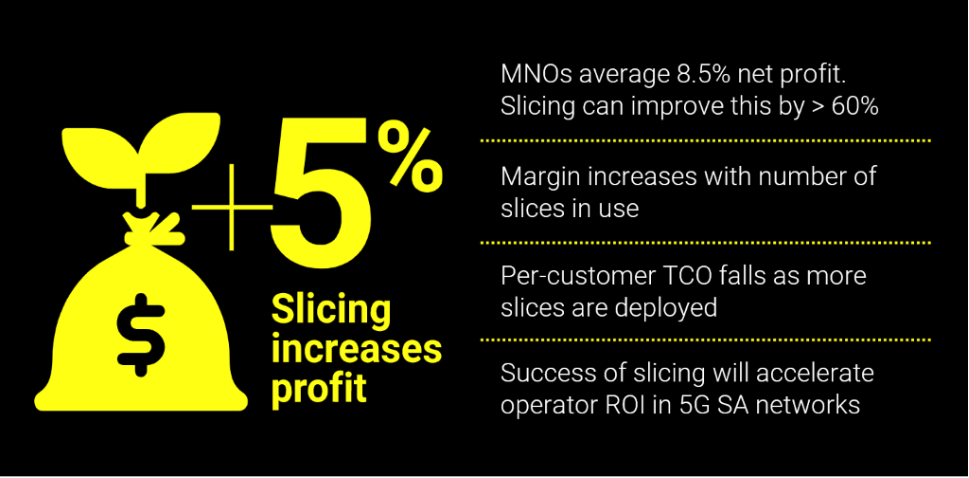

Imagine what the world would be like if network operators could net anywhere close to average gross profit margins of 80-90%! (Investopedia, 2018.) That will never happen, of course, because no matter how you slice the pie, OpEx and CapEx always eats up a good chunk of revenue. But, by strategically deploying network slice-based services as 5G ramps up, it is possible to get a lot closer than current average net profit of 8.5% (Investopedia 2018)--and do so in only a few years.

How much closer? Slice-based services will add 5% to the bottom line by 2026, representing a much-needed 38% increase in profits (Nokia/Bell Labs 2018).

That could be just the boost communications service providers (CSPs) need. Their operating margins are already tight—OpEx as percentage of revenue grew from 11% in 2012 to 15% in 2017, while revenue declined 13% (Analysys Mason, 2020)— and they are investing a lot in 5G but won’t begin to see significant revenue from these new services for 3-7 years after launch. Anything that can accelerate ROI is worth pursuing.

About 15% of subscribers are interested in premium connectivity services, and every 1% increase in those customers delivers three percentage points revenue increase (Nokia, citing Bell Labs stats, 2018). That’s good news for operators that have already made significant progress deploying virtualization and cloud technologies: network slices, supported by the same underlying infrastructure, can be rapidly deployed to deliver services commanding premium revenue.

Of course, network slicing isn’t a silver bullet and there are several factors to consider around how to make these kinds of services as profitable as possible, as quickly as possible.

First, there is an economies-of-scale consideration: Network slicing starts delivering greater operating margin than dedicated networks when more than about ten slices are created (Nokia 2018). After that point, operating margin stays flat or decreases for dedicated networks, but continues to grow with network slicing.

Second, relatedly, per-customer total cost of ownership (TCO) falls as more slices are deployed.

Finally, automating network management is crucial to minimize operational costs, thereby enabling more network slices, more connections, and more revenue. Even incomplete automation brings down the operational costs of network slices to the point where they are economically beneficial. The TCO for even high numbers of network slices becomes acceptable with full automation, which operators will achieve eventually.

In the meantime, even partial automation can reap significant dividends. MNOs’ focus should be—and largely is—on merging siloed systems, and deploying real-time monitoring and analytics supported by artificial intelligence to integrate automation with operations in a meaningful way.

Automation is an incremental process—from simple process automation and multi-system integration to AI-based root cause analysis to closed-loop, autonomous networks—in which steps really cannot be leap-frogged over. But it need not take a decade to get to a stage where investment begins to reap rewards. Coupled with network slicing, there is a light at the end of the not-that-long-after-all tunnel!