Open RAN builds momentum in 5G deployments and brings new challenges

O-RAN market momentum is building although it will not overtake traditional RAN spending until 2028, according to Deloitte Consulting. At the end of 2020 there were nearly 40 commercial O-RAN deployments around the world, which is about one-third of the total number of live 5G networks.

Most of the O-RAN networks and use cases to date are focussed on rural coverage. Operators include Vodafone in Africa, Turkey, the UK and Ireland; MTN in Nigeria; and Telefonica in the Middle East, Africa, and South America. Rakuten in Japan is running the first live network built on O-RAN and claims 40% lower cost than traditional networks. Dish, Charter and AT&T in the U.S. are looking to fully deploy O-RAN within the wider network for all their broadband and 5G needs. Orange Group also believes O-RAN will heavily reduce their network infrastructure and operations costs.

O-RAN can provide 5G coverage in rural areas, where it is harder to justify a business case for using standard network equipment. Using Open RAN for rural 5G deployments can also enable telcos to achieve regulatory coverage requirements in a cheaper and faster way.

Cost drivers and sharing benefits of O-RAN

Their main driver is to reduce the total cost of ownership (TCO) of the network using O-RAN, standard hardware and virtualized network functions. The ability to decompose and split components and move away from closed single-vendor solutions will drive competition and open up the supply chain. Open platforms allow mobile network operators (MNOs) to choose the best-of-breed solution for any given function, and to change that in the future as new choices emerge. This will also allow MNOs to enhance their networks and services on a rapid (eventually continuous) basis rather than having to wait for a major upgrade every few years. ORAN will also accelerate RAN sharing deployments while reducing costs.

The overall sharing of network infrastructure is a key driver in cost reduction, but can be complex. Any operator considering network sharing will look at O-RAN to reduce RAN sharing costs, especially in less competitive rural markets. Every country in the EU has passive and active sharing agreements (e.g., sharing sites and masts and multi-tenant sharing (MORAN)) but O-RAN makes full active sharing possible, including the core, which can deliver further savings.

New O-RAN architecture presents performance monitoring challenges

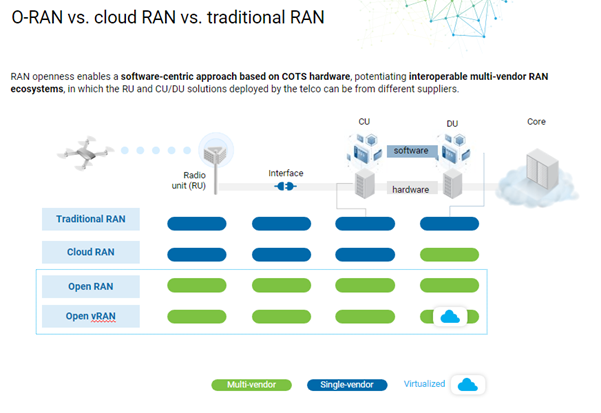

A big change with ORAN is the decomposition of radio and baseband unit (BBU) resources to central (CU) and distributed (DU) units—in other words the radio will be distributed whereas the processing will be centralized. Traditionally a single vendor has provided this as a single set of software and hardware. With cloud RAN, the software was decomposed to run on any standard hardware. Now, O-RAN fully decomposes the CU and DU, opening up the potential to use new and different vendors for these components. In virtualized O-RAN, the CU and DU are virtualized as virtual network functions.

As O-RAN opens up an ecosystem of vendors, the role of independent testing and monitoring will become more important in order to ensure interoperability, fast troubleshooting and quick problem resolution. Operators are moving from a single vendor network to multiple vendors and components and will require a standardized way to assess interoperability and monitor performance—ideally in real time. Prior to going live, operators will need to perform tests to ensure that everything is working. The interface between the components also needs to be monitored to see if faults are caused by one vendor or another or the interface between them.

(Source: Deloitte Consulting)

EXFO helps operators reduce O-RAN testing complexity

In the roll-out phase, operators cannot risk a poor customer experience. They will need to validate new site performance and confirm that customers are receiving the right quality of experience (QoE) for the services they are paying for.

EXFO can test and measure interoperability in the lab and assure the live network interactions with O-RAN and the core, the F1 interface, as well as interactions and fault visibility between the components. EXFO’s Nova RAN solution can ingest and analyze data from any vendor to prevent and predict faults from occurring in the first place. A key enabler of efficiency and reducing OPEX will be automated processes that can integrate with the RAN Intelligence Controller (RIC) and drive near real-time automation of problem detection and resolution.

5G is not just another radio technology, it requires end-to-end network transformation and enables a new set of capabilities. EXFO has the advantage of providing full 5G test and monitoring solutions to assure services end-to-end from the RAN to the core. The initial challenge for O-RAN with 5G is that standardization is not there yet. Components and interfaces are still being adapted which results in variation between vendors making it harder for operators to standardize their operations.

Independent test and measurement and service assurance vendors such as EXFO are vendor-agnostic and can simplify and reduce the complexity of multi-vendor networks that are a mix of traditional and O-RAN components. EXFO’s Nova platform can act as a single interface that understands and interacts with the vendors’ standardized interfaces in the core and the RAN to present control and user metrics and KPIs in a standardized way. This will help deliver automated real time network operations and in-depth insights.

Another benefit is that EXFO helps to reduce the time and complexity spent trying to access multiple systems in order to piece together and understand different vendor metrics. It also reduces training and process costs for systems and tools. EXFO not only provides a strong technical solution but also related professional services which can support operators in the adoption of processes and best practices through to the undertaking of specific analytics, troubleshooting and optimization activities.